how much tax is deducted from a paycheck in missouri

Add your state federal state and voluntary deductions to determine your net pay. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Ready To Use Paycheck Calculator Excel Template Msofficegeek

You should use the Line references.

. A Social Security tax of six percent is in. The Missouri bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The taxable income for the state is the same as.

Any company or corporation violating this requirement shall pay each affected person 50 which can be recovered through court action. The amount of money you. In 2019 the highest tax rate applied to annual income of more than 8424.

Missouri has a progressive income tax system with income tax rates that range from 15 to 54. This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis. Do not use the amount of federal tax withheld from your Form W-2.

Details on how to only prepare and print a Missouri 2021 Tax Return. Missouri Hourly Paycheck Calculator. Switch to Missouri salary calculator.

Section 143174 RSMo provides a deduction for military income earned as a member of the active duty component of the Armed Forces of the United States. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This means you must pay your income taxes to the IRS throughout the year instead of paying the whole amount due on April 15.

The deduction is for the amount actually paid as indicated on your Federal Form and NOT the amount withheld by your employer that is listed on your Form W-2. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. How much tax is deducted from a paycheck in Delaware.

ADP Salary Payroll Calculator. That 14 is called your effective tax. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income.

There is no income limit on Medicare taxes. Select your location and add a salary amount to find out how much federal and state taxes. If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. A resident of St. 5 rows What Percentage Is Taken Out Of Paycheck Taxes.

A financial advisor in Missourican help you understand how taxes fit into your overall financial goals. In addition any residents as well as. The average taxpayer gets a tax refund of about 2800 every year.

Employers can use the calculator rather than manually looking up withholding tax in tables. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. In Missouri income tax is levied at 25.

Payroll taxes and income tax. With a median household income of about 36000 according to the Missouri census most Missouri taxpayers would currently have most of their income taxed at the highest. The top tax bracket is 53 which applies to employees who make more than 858500 annually.

Missouri Income Tax Forms. Below is some helpful information regarding the military deduction. Your employer is also responsible for withholding FICA taxes from your wages.

This deduction may be claimed on the Military Income Deduction line of the Missouri Individual Income Tax Return Form MO-1040. The withholding calculator is designed to assist. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

Its a progressive income tax meaning the more money your employees make the higher the income tax. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits. Louis or Kansas City is subjected to local income tax of 1.

145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. No state payroll tax. An employer may deduct funds from an employees wages for cash register shortages damage to equipment or for similar reasons.

Tax Professionals can use the calculator when testing new tax software or assisting with tax planning. Missouris top income tax rate is set to drop to 510 over the course of the next few years. Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

Missouri State Income Tax Forms for Tax Year 2021 Jan. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket. Neuvoo Salary and Tax Calculator.

The State of Missouri allows a deduction on your individual income tax return for the amount of federal tax you paid. Has a standard deduction and no exemption. Employers withhold or deduct some of their employees pay in order to cover.

Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. Below are forms for prior Tax Years starting with 2020. Missouri tax year starts from July 01 the year before to June 30 the current year.

How much tax is deducted from paycheckOverview of new york taxesgross paycheck3146federal income1418446state income509160local income350110fica and state insurance taxes780246 Understanding paycheck deductions what you earn based on your wages or salary is called your gross income. If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS. These are Social Security and Medicare taxes and they are withheld at rates of 62 and 145 of your wagesIncome Tax Brackets.

This will happen if the states revenue meets a certain growth rate or level resulting in a triggered tax cut.

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Salary Paycheck Calculator Calculate Net Income Adp

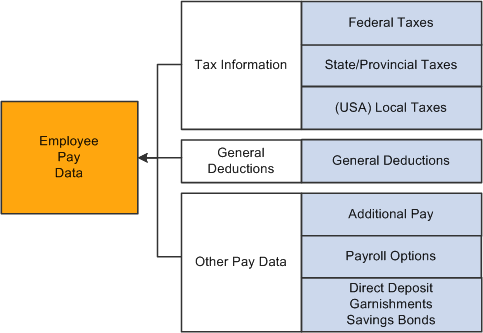

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

How To Do Payroll In Excel In 7 Steps Free Template

Can I Get A Pay Stub On My First Day On The Job Quora

What Can I Deduct From My Employee S Paycheck Exaktime

Salary Paycheck Calculator Calculate Net Income Adp

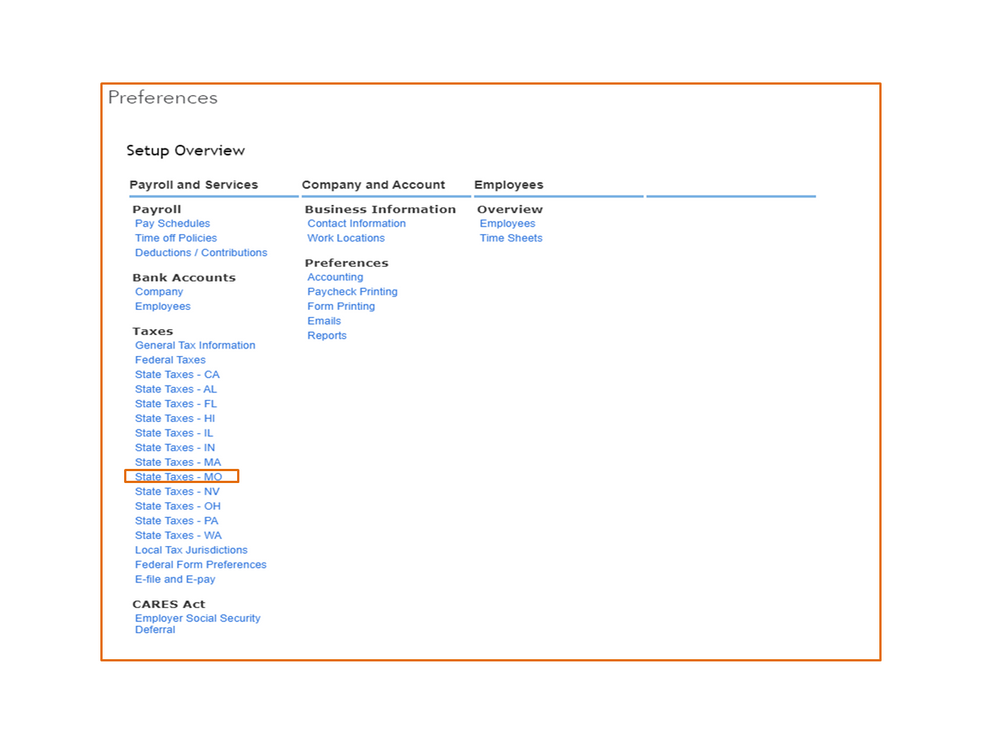

Missouri Withholding Tax Compensation Deduction

What Is A Pay Stub Paystubs Net

Damians Deductions 1 1 3 Docx Paycheck Deductions All Sorts Of Deductions Are Taken Out Of People U2019s Paychecks Some Deductions Were For The Course Hero

Peoplesoft Payroll For North America 9 1 Peoplebook

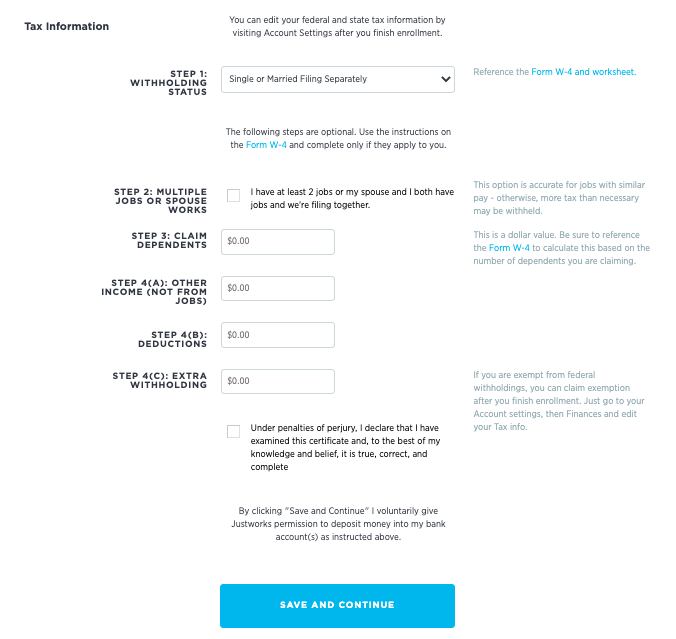

Questions About My Paycheck Justworks Help Center

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Pay Stub Requirements By State Overview Chart Infographic

Payroll Tax What It Is How To Calculate It Bench Accounting

Paystub Generator Build Your Pay Stub Payroll Template Statement Template Business Checks